Retire Rich & Happy

Retailer in the Spotlight - Lululemon | 6.7.24

Lululemon Steals the Show

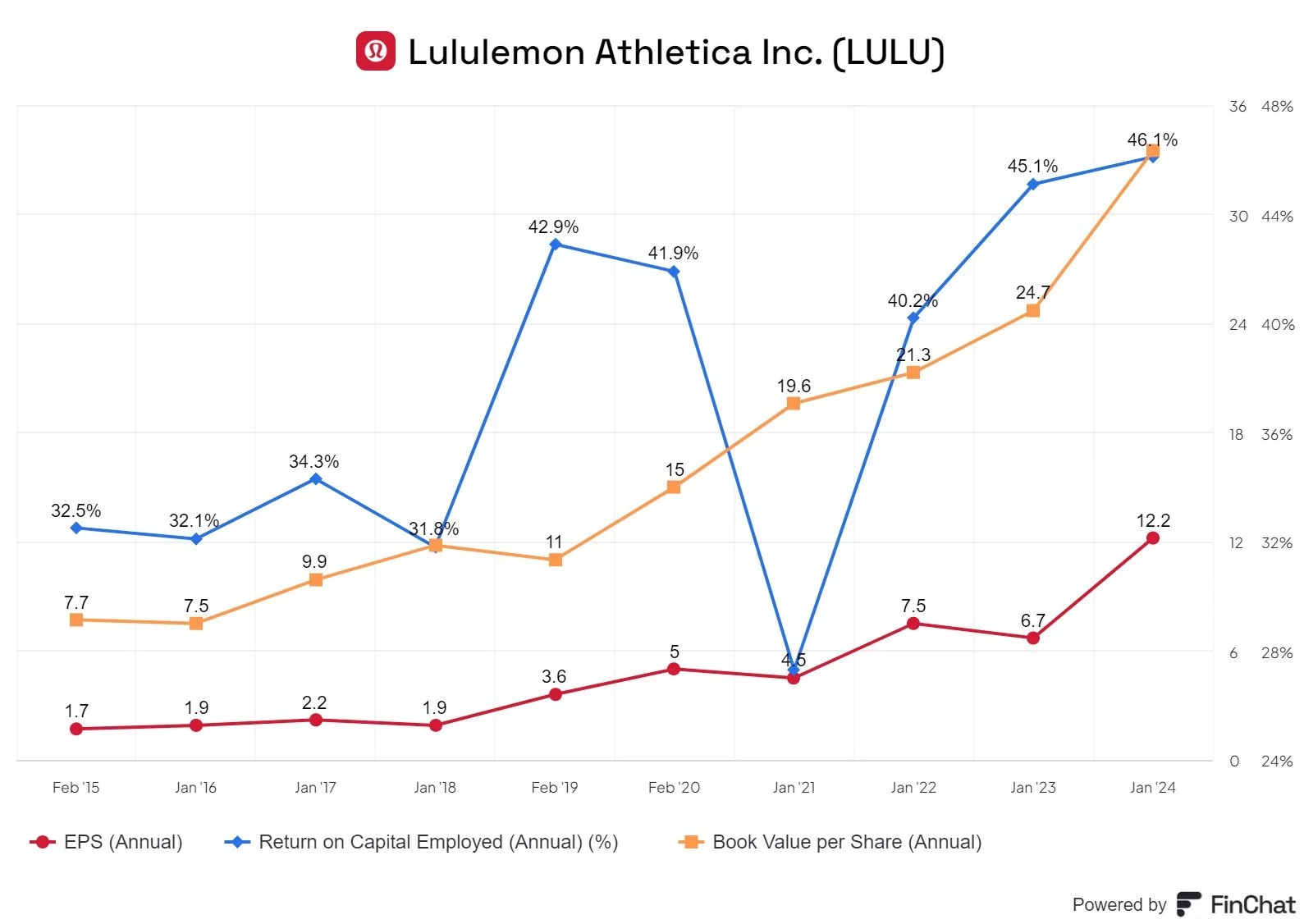

At Eaglestone Capital, we love companies that earn high returns on capital employed (ROCE) while growing earning per share (EPS) and compounding book value. Case in point, Lululemon (LULU) reported this week that it has grown EPS 7.2x, grown book value 4.5x and grown ROCE 44% over the past 9 years while their share price has compounded at an annual rate of 20% (returned 5.1x the original share price). As of June 5, 2024, the Company had approximately $1.7 billion remaining authorized under its stock repurchase program.