Eaglestone Capital

Investors Edge Podcast S1:E3

https://youtu.be/HUxo13Zf_90?si=WVc_rGVikrfZBZHl

Navigating the Complex World of Property & Casualty Insurance Investing

In this episode of the Investors Edge Podcast, host Fred Stupart dives deep into the property and casualty (P&C) insurance market, exploring investment opportunities and the nuances of evaluating P&C insurers. Fred revisits the aftermath of Hurricane Milton, examines the concept of insurance float, shares insights on past insurance market challenges like the AIG collapse, and compares P&C insurance to health insurance. With a focus on underwriting discipline and investment returns, this episode offers a comprehensive analysis of why P&C insurers can be a compelling asset class. Don't miss Fred's detailed breakdown of how to evaluate insurers using metrics like the combined ratio and return on insurance float.

00:00 Introduction to the Investors Edge Podcast

00:30 Understanding the Property and Casualty Insurance Market

00:40 The Impact of Hurricane Milton on Insurance Stocks

00:57 Why Invest in Property Casualty Insurance Companies?

02:23 Challenges and Opportunities in the Insurance Industry

03:58 The AIG Collapse: A Case Study

08:05 The Importance of Good Management in Insurance

09:13 Deep Dive into the U.S. Property Casualty Insurance Market

12:18 Evaluating Insurance Companies: Metrics and Strategies

16:30 Comparing P&C Insurance with Health Insurance

27:12 State Farm and the Current P&C Insurance Market

28:25 Valuation of P&C Insurance Companies

31:45 Conclusion and Final Thoughts

Investors Edge Podcast S1E3: Navigating the Complex World of Property & Casualty Insurance Investing

In this episode of the Investors Edge Podcast, host Fred Stupart dives deep into the property and casualty (P&C) insurance market, exploring investment opportunities and the nuances of evaluating P&C insurers. Fred revisits the aftermath of Hurricane Milton, examines the concept of insurance float, shares insights on past insurance market challenges like the AIG collapse, and compares P&C insurance to health insurance. With a focus on underwriting discipline and investment returns, this episode offers a comprehensive analysis of why P&C insurers can be a compelling asset class. Don't miss Fred's detailed breakdown of how to evaluate insurers using metrics like the combined ratio and return on insurance float.

00:00 Introduction to the Investors Edge Podcast

00:30 Understanding the Property and Casualty Insurance Market

00:40 The Impact of Hurricane Milton on Insurance Stocks

00:57 Why Invest in Property Casualty Insurance Companies?

02:23 Challenges and Opportunities in the Insurance Industry

03:58 The AIG Collapse: A Case Study

08:05 The Importance of Good Management in Insurance

09:13 Deep Dive into the U.S. Property Casualty Insurance Market

12:18 Evaluating Insurance Companies: Metrics and Strategies

16:30 Comparing P&C Insurance with Health Insurance

27:12 State Farm and the Current P&C Insurance Market

28:25 Valuation of P&C Insurance Companies

31:45 Conclusion and Final Thoughts

Investors Edge Podcast S1:E2

https://youtu.be/v37MBHy5mWw?si=oELOyd-064REggB6

In this episode of the Investor's Edge Podcast, host Fred Stupart dives into the distinction between share price volatility and business fundamentals. The discussion features insights from Warren Buffett on the limitations of volatility as a risk measure, real-world examples from Hurricane Milton's impact on insurance stocks, and perspectives from Howard Marks on the true nature of risk. Tune in to learn why share prices can move independently of business performance and how this volatility can present opportunities for individual investors.

00:00 Introduction to Investor's Edge Podcast

00:28 Understanding Share Price Volatility

02:57 Real-World Example: Hurricane Milton's Impact

04:03 Analyzing Insurance Stocks: Kinsale and Arch Capital

07:09 Howard Marks on Risk and Volatility

10:35 Measuring Volatility and Risk Metrics

12:11 Conclusion and Final Thoughts

Investors Edge Podcast Episode 2: Understanding Share Price Volatility vs. Business Fundamentals

Understanding Share Price Volatility vs. Business Fundamentals | Investor's Edge Podcast

In this episode of the Investor's Edge Podcast, host Fred Stupart dives into the distinction between share price volatility and business fundamentals. The discussion features insights from Warren Buffett on the limitations of volatility as a risk measure, real-world examples from Hurricane Milton's impact on insurance stocks, and perspectives from Howard Marks on the true nature of risk. Tune in to learn why share prices can move independently of business performance and how this volatility can present opportunities for individual investors.

00:00 Introduction to Investor's Edge Podcast

00:28 Understanding Share Price Volatility

02:57 Real-World Example: Hurricane Milton's Impact

04:03 Analyzing Insurance Stocks: Kinsale and Arch Capital

07:09 Howard Marks on Risk and Volatility

10:35 Measuring Volatility and Risk Metrics

12:11 Conclusion and Final Thoughts

Investors Edge Podcast S1:E1

https://youtu.be/b7yxh9u_VK8?si=juiaDbkHVA-yeqOu

Episode 1: Navigating Market Emotions and Rational Decisions: Insights from Past Crises

In this episode of the Investor's Edge podcast, host Fred Stupart delves into the psychology of investing, highlighting how emotions can cloud rational thinking during volatile market conditions. He shares his experiences from the Asian currency crisis of 1997-1998 and the COVID-19 pandemic's initial market impact in 2020. Fred analyzes a real-time interview with investor Bill Ackman to illustrate the clash between emotional and logical decision-making. He also references Daniel Kahneman's System 1 and System 2 thinking to explain how investors can better manage their reactions and decisions. Join us for valuable lessons on recognizing and overcoming biases and fears in investing.

00:00 Introduction to the Investor's Edge Podcast

00:36 Understanding Investing Psychology

00:55 Historical Market Volatility: 1997-1998

01:52 COVID-19: A Recent Case Study

03:27 Bill Ackman's Emotional vs. Rational Battle

05:21 Analyzing COVID-19's Impact on Markets

11:51 Daniel Kahneman's System 1 vs. System 2 Thinking

16:20 Conclusion and Takeaways

Episode 1: Navigating Market Emotions and Rational Decisions: Insights from Past Crises

In this episode of the Investor's Edge podcast, host Fred Stupart delves into the psychology of investing, highlighting how emotions can cloud rational thinking during volatile market conditions. He shares his experiences from the Asian currency crisis of 1997-1998 and the COVID-19 pandemic's initial market impact in 2020. Fred analyzes a real-time interview with investor Bill Ackman to illustrate the clash between emotional and logical decision-making. He also references Daniel Kahneman's System 1 and System 2 thinking to explain how investors can better manage their reactions and decisions. Join us for valuable lessons on recognizing and overcoming biases and fears in investing.

00:00 Introduction to the Investor's Edge Podcast

00:36 Understanding Investing Psychology

00:55 Historical Market Volatility: 1997-1998

01:52 COVID-19: A Recent Case Study

03:27 Bill Ackman's Emotional vs. Rational Battle

05:21 Analyzing COVID-19's Impact on Markets

11:51 Daniel Kahneman's System 1 vs. System 2 Thinking

16:20 Conclusion and Takeaways

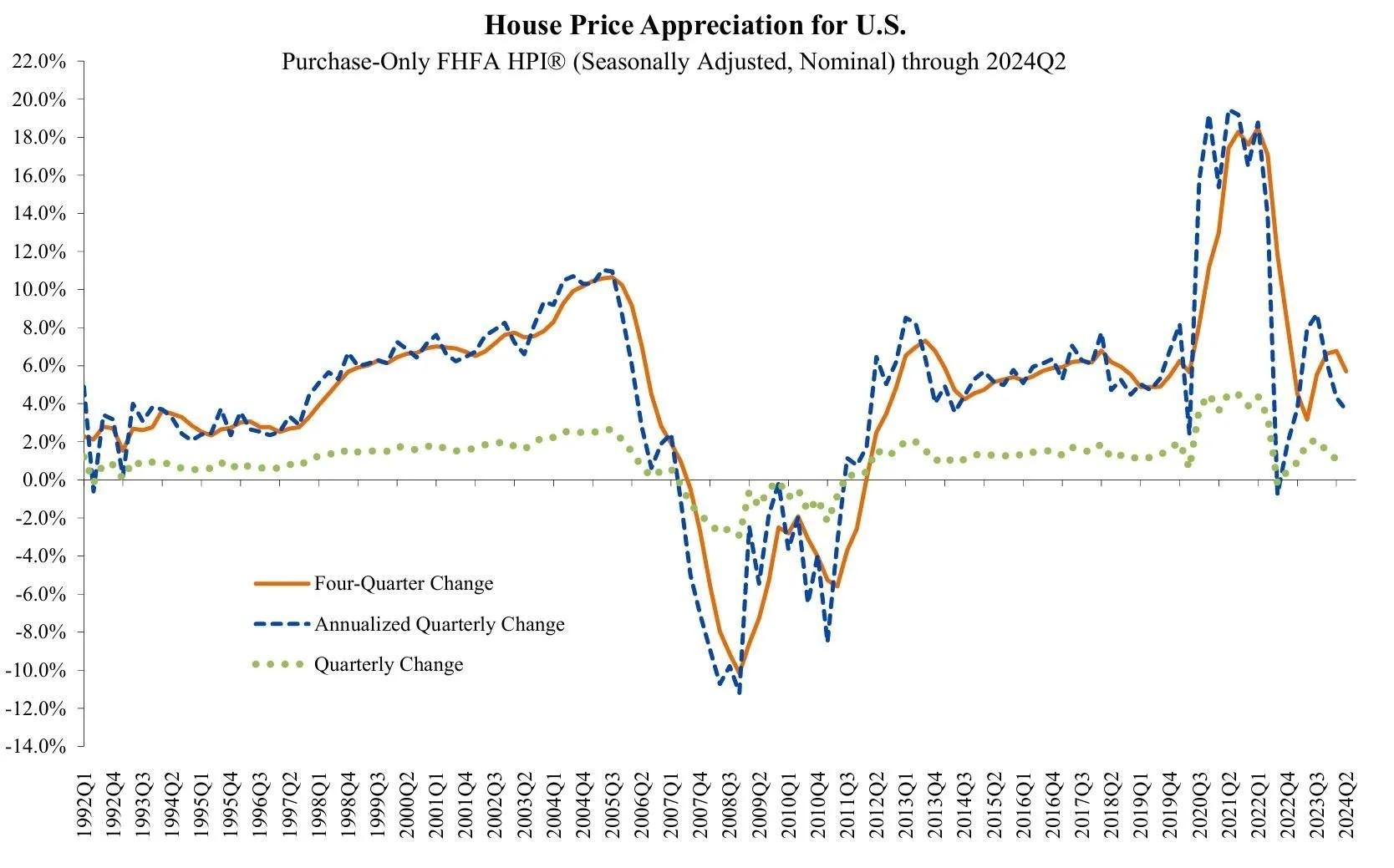

U.S. House Prices Rise 5.7 Percent over the Last Year

The U.S. house prices increased by 5.7% from the second quarter of 2023 to the second quarter of 2024, as reported by the FHFA House Price Index (HPI). This marks a 0.9% rise from the first quarter of 2024. However, on a monthly basis, the seasonally adjusted index for June 2024 showed a slight decline of 0.1% compared to May 2024.

Dr. Anju Vajja, Deputy Director for FHFA’s Division of Research and Statistics, noted that this slowdown in quarterly growth is attributed to a higher inventory of homes for sale and elevated mortgage rates, which have tempered the pace of appreciation in the housing market.

However, a decline in mortgage rates could help to drive the market higher in future quarters.

Travelers (TRV) vs Progressive (PGR) - Not all Insurance Companies Are Created Equal

This past week, both Travelers (TRV) and Progressive (PGR) reported 2Q2024 financials and interestingly they demonstrated the importance of a good underwriting platform. Progressive derives about 85% of its premiums earned underwriting personal auto/vehicle and home insurance. For the 2Q2024, PGR grew premiums earned by 19% year over year and generated $1.4 billion of underwriting income with a combined ratio of 91.9%. In contrast, for 2Q2024 TRV grew its personal auto & home insurance premiums earned 10% to $4.1 billion but given its underwriting losses and expenses (its combined ratio was 108.5%) it generated an underwriting loss of $296 million.

Given this fundamental divergence in the core underwriting platforms of the two companies its no surprise that over the past 5 years PGR’s stock has compounded at an annual rate of 25% while TRV’s stock has compounded at an annual rate of 8% - quality matters.

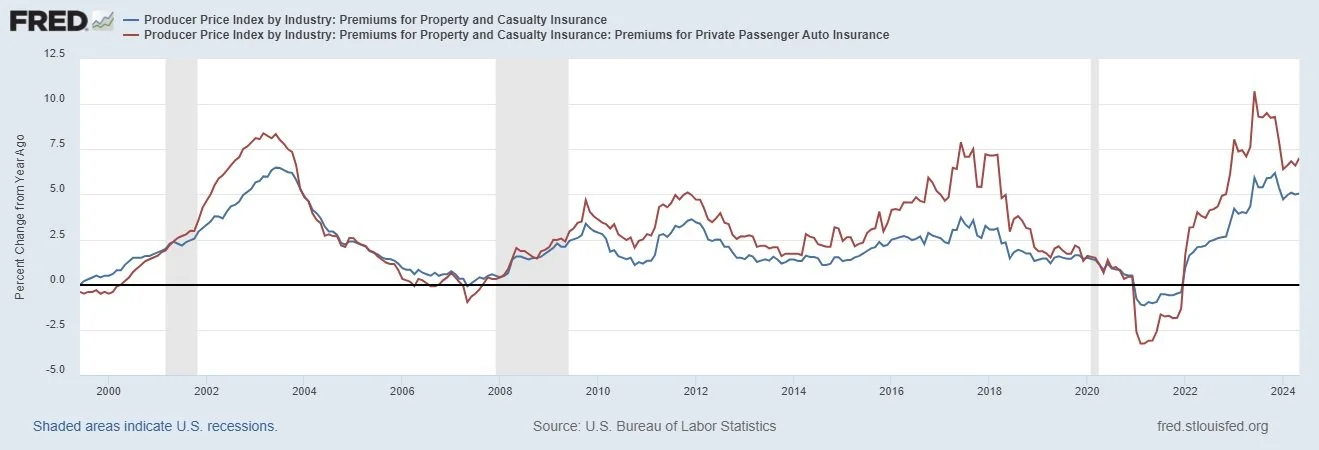

The Bull Run in Property & Casualty (P&C) Insurance Continues

But Not All P&C Insurance Companies Will Benefit

A recent article “State Farm Seeking Large Rate Increases in Wildfire-Prone California” caught my attention and raised alarm bells regarding the financial condition of the largest P&C insurer in California (State Farm insures about 20% of all California homes) and indeed the largest P&C insurer in the country (NAIC 2024 Market Share Report). Apparently State Farm is requesting a 30% rate increase for its homeowners line, a 52% rate increase for renters and 36% rate increase for condo coverage - that’s a year after the carrier got California rate approvals of 7% and 20%—adding fuel to a burning homeowners crisis in a state that’s seen an increasing number of carriers pullback or raise rates in the last year.

State Farm is not doing well - they reported a monster $14.1 billion underwriting loss in FY2023 and that’s after a $13.2 billion underwriting loss in FY2022.

Which P&C insurers are earning underwriting profits? The U.S. P&C insurance market has been on a tear for the past several years - and recent May 2024 premium data continues to demonstrate strength with lines like personal auto up over 7% year over year.

Take a look at a well run P&C re-insurer such as Arch Capital Group Ltd. (ACGL) which has been generating underwriting profits for the past decade -most recently in 1Q2024 ACGL grew revenues at a 29% annual rate and generated returns on book equity over 29% while the stock trades at 8x earnings.

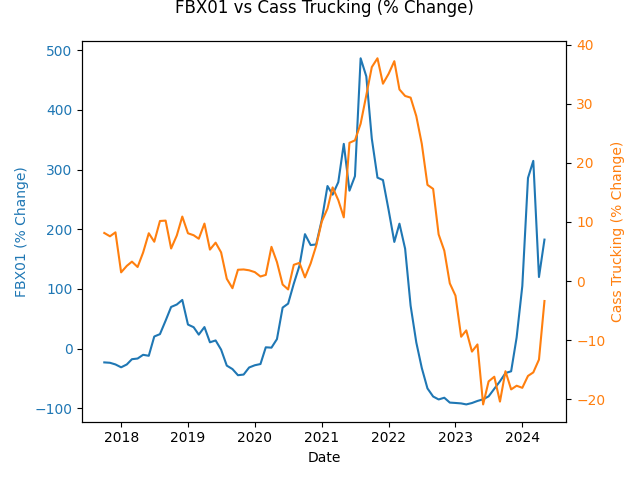

China/U.S. Freight Costs Rising - Is the U.S. Supply Chain Next?

How to Play A Rebounding U.S. Supply Chain

Domestic LTL Trucking Companies Offer an Attractive Option

Over the past two months, we’ve been following re-bounding 40’ ocean going container rates, specifically the cost to ship goods from China to the U.S. West Coast. The Freightos FBX01 rate for example has risen over 127% from $3095 in April 2024 to over $7052 as of last week.

A number of explanations exist - disruptions in the Red Sea, retailers pre-buying in fear of post-election tariffs - however, there’s also something happening in the domestic supply chain that suggests the effects might be more substantial. Inferred rates withing the domestic Cass Freight Index have started to move and historically changes in the price of the two indexes (FBX01 and Cass Freight Index Inferred Prices) have been strongly corelated using a 5 month lag (i.e. the FBX01 rates “forecast” the Cass Freight Inferred Prices with a 5 month lag).

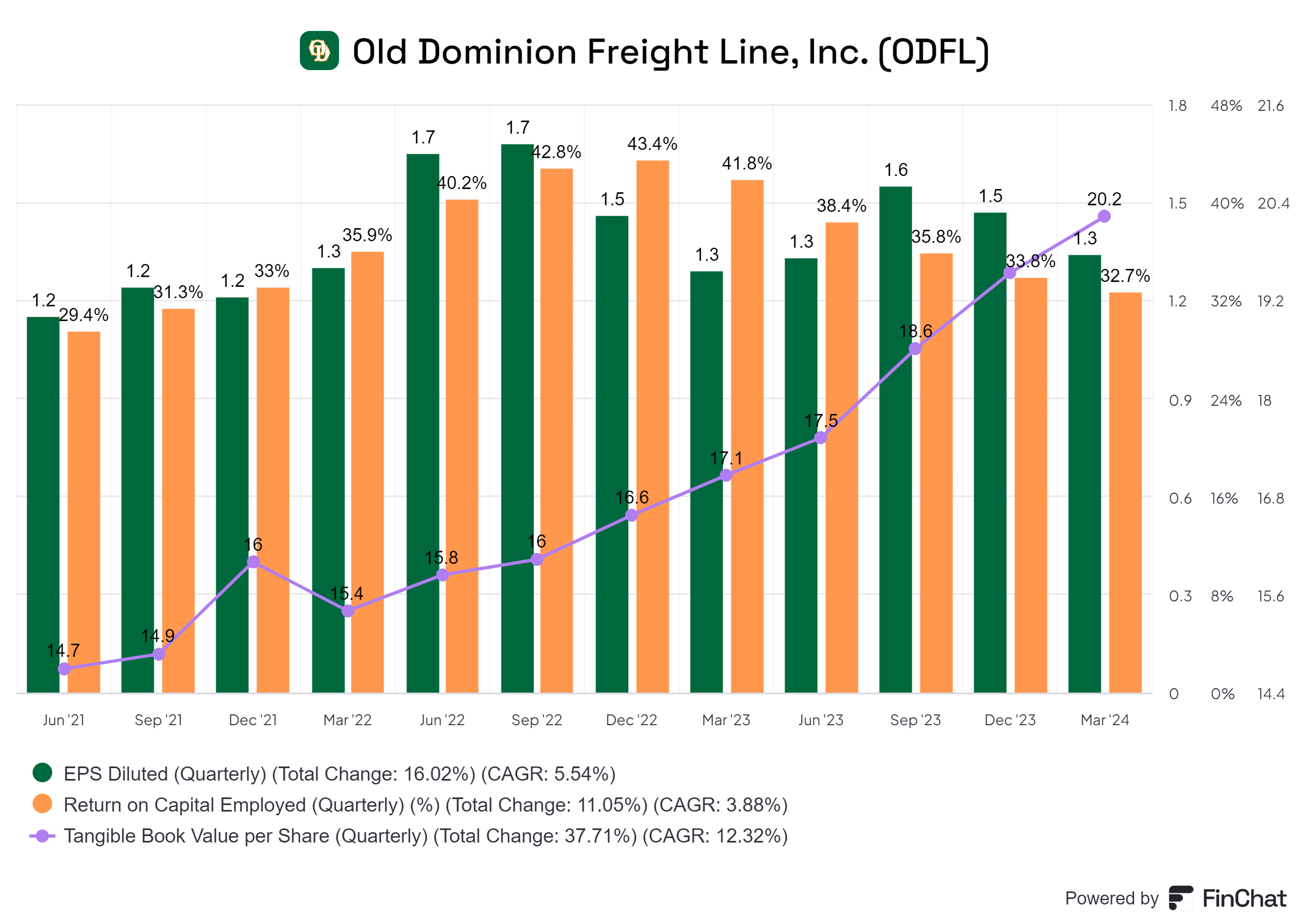

One idea is to look at the LTL trucking industry - Old Dominion Freight Lines (ODFL) for example. ODFL has demonstrated strong returns on capital employed (ROCE) over the years - over 30% - as well as consistently building book value per share through high returns and re-investment - all for the benefit of its shareholders.

Residential Construction Update - Is the Market Rolling Over?

KB Home & Lennar Report 2Q2024 Results

KB Home (KBH) reported earnings for the quarter ending May 31, 2024 this week. Year over year, net orders were up 2%, net order value was up 7% and average selling price was up 1% however total housing revenues declined 3%, deliveries declined 4% and backlog homes declined 14%.

Lennar (LEN) also reported for the 2Q2024 - revenues increased 9% primarily due to a 15% increase in the number of home deliveries offset by a 5% decline in average selling price. Stuart Miller, CEO noted that: “affordability continued to be tested by interest rate movements and simultaneously challenged consumer sentiment, purchasers remained responsive to increased sales incentives, resulting in a 19% increase in our new orders and a 15% increase in our deliveries year over year.” However, new order prices were down 5.5% while backlog average selling price was down 2.3%

So far YTD 2024 LEN stock price is up 3.7%, KBH is up 13.7% and other residential construction players such as insulation supplier/installer TopBuild (BLD) are up 3.7% this year. Lumber prices, however, are down over 20.8% YTD.

Do Home Prices Help Predict Single Family Housing Starts?

And which ‘House Price’ Index can we trust anyways?

Going down a rabbit hole trying to find some reliable macro indicators is usually a bad idea. It turns out, that I learned something about the differences between the variety of home price indexes - and these differences appear to be statistically significant (you can read more here).

While the median home price index of the National Association of Relators (NAR) is fast to report, usually within 3 weeks of month end, the FHFA House Price Index (FHFA) and the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index (CoreLogic) usually post 7 weeks following the month end. In fact, both FHFA and CoreLogic are reporting April 2024 numbers this Tuesday June 25th.

Digging through these indexes using data starting over 30 years ago in order to test for correlation between these home price indexes and single family housing starts yields some interesting results.

The home price index that best fits a simple four month lagged prediction model of single family housing starts is the FHFA. So pay attention to the trajectory of the FHFA this week. Why? The FHFA hasn’t printed a negative year over year price decline since the end of the global financial crisis in February 2012. The FHFA reported a year over year decline for the first time in the summer of 2007 and continued to show monthly price declines until March of 2012 when it reported a year over year price increase. FHFA slowed as the Fed began raising rates in 2022 and hit a low of 3% in May 2023 before rebounding over the past year. The most recent FHFA reading for March 2024 showed 6.75% year over year home price growth.

Insulate Your Portfolio

Residential Construction Industry

TopBuild Grows Despite Slowing Housing Market

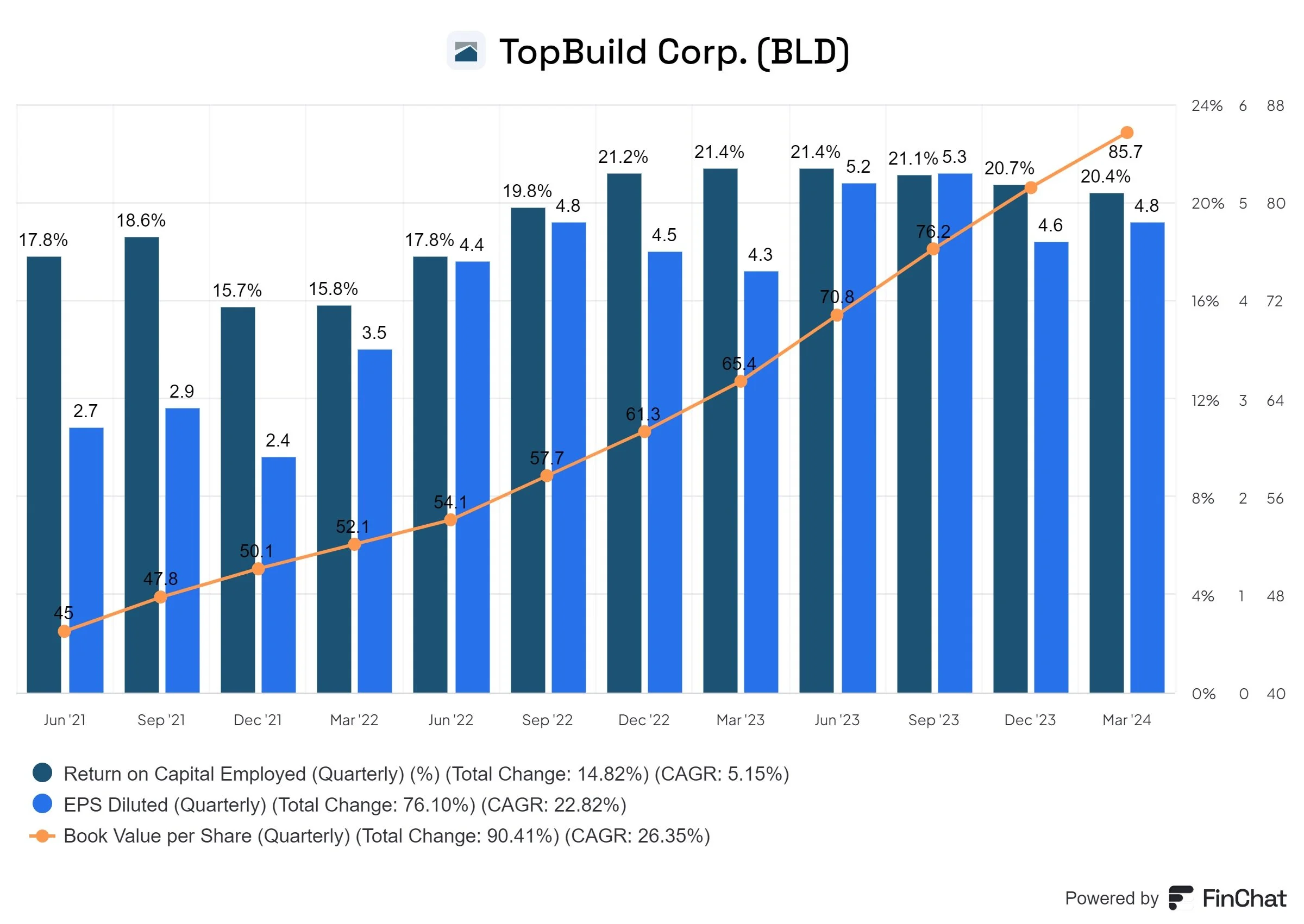

TopBuild Corp. (NYSE: BLD) headquartered in Daytona Beach, Florida engages in the installation and distribution of insulation and related building products. A majority of the business is currently focused on the new build residential construction market. 1Q2024 sales grew 1.1% YoY while operating earnings grew 8.2% YoY.

TopBuild has successfully kept ROIC above 20% since 2022 while growing book value, maintaining operating margin of 16.7% and reducing its share count.

Comfort from the Heat

Construction Industry - Comfort Systems USA | 6.17.24

Comfort Systems USA is Cool

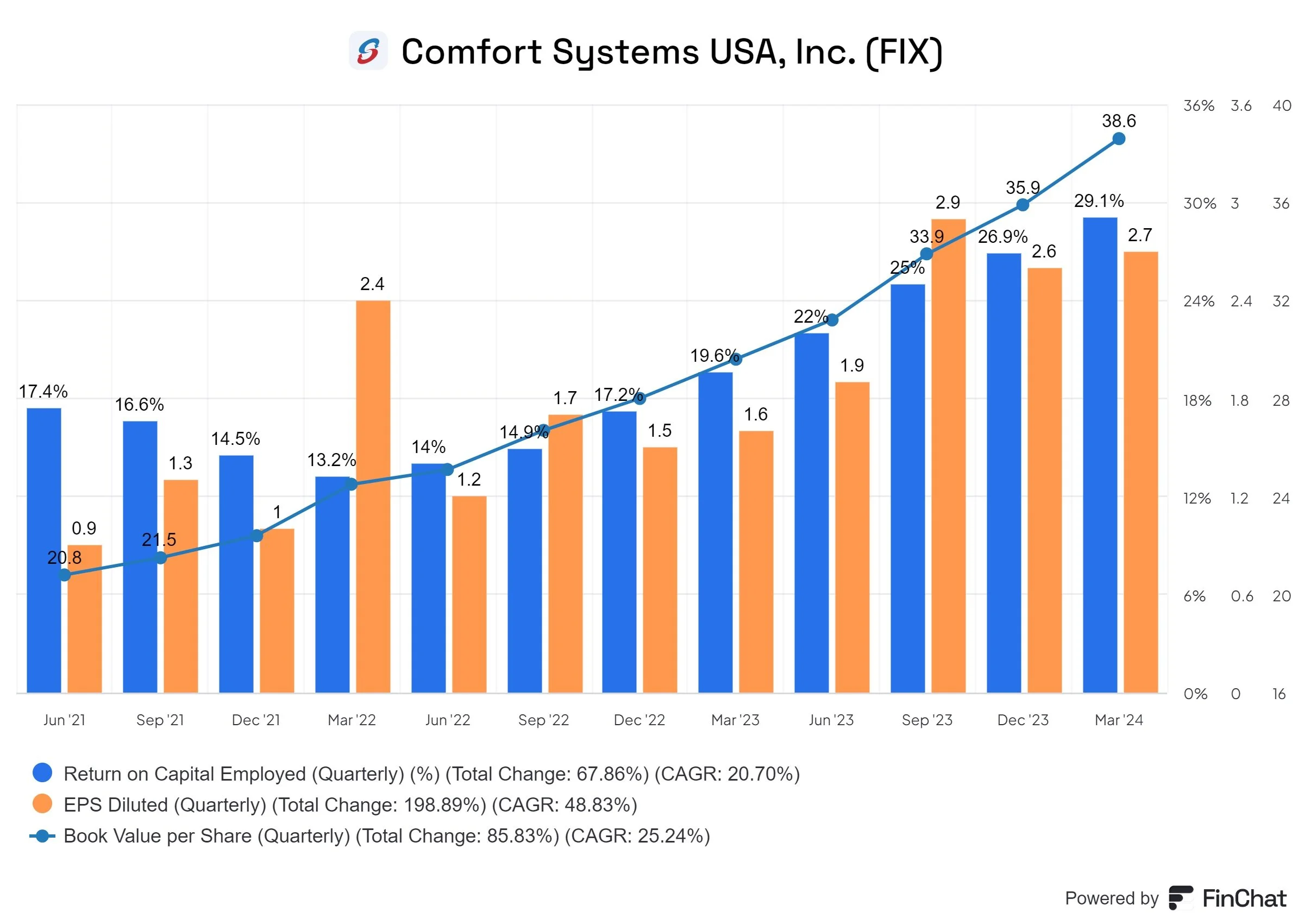

This week we’re digging into the U.S. construction sector. Why? The most recent economic data from April 2024 points to continued strength in construction spending - whether its the 11.4% annual growth in single family housing starts, the 8.1% annual growth in residential construction spending or the 11.5% annual growth in non-residential construction spending.

Comfort Systems (NYSE:FIX) based in Houston, TX is focused on the new build commercial & industrial heating ventilation and air conditioning (HVAC) services market. FIX has been growing rapidly - in 1Q2024 revenues increased 31% year over year (YoY) and operating income increased 91% YoY.

At Eaglestone Capital, we love companies that earn high returns on capital employed (ROCE) while growing earning per share (EPS) and compounding book value. Over the past year, FIX grew EPS 78% and book value per share 30% while growing ROCE from 19.6% to 29.1% over the past year.

Shelter from the Storm

P&C Insurance - Kinsale Capital | 6.7.24

Every Dog Has His Day

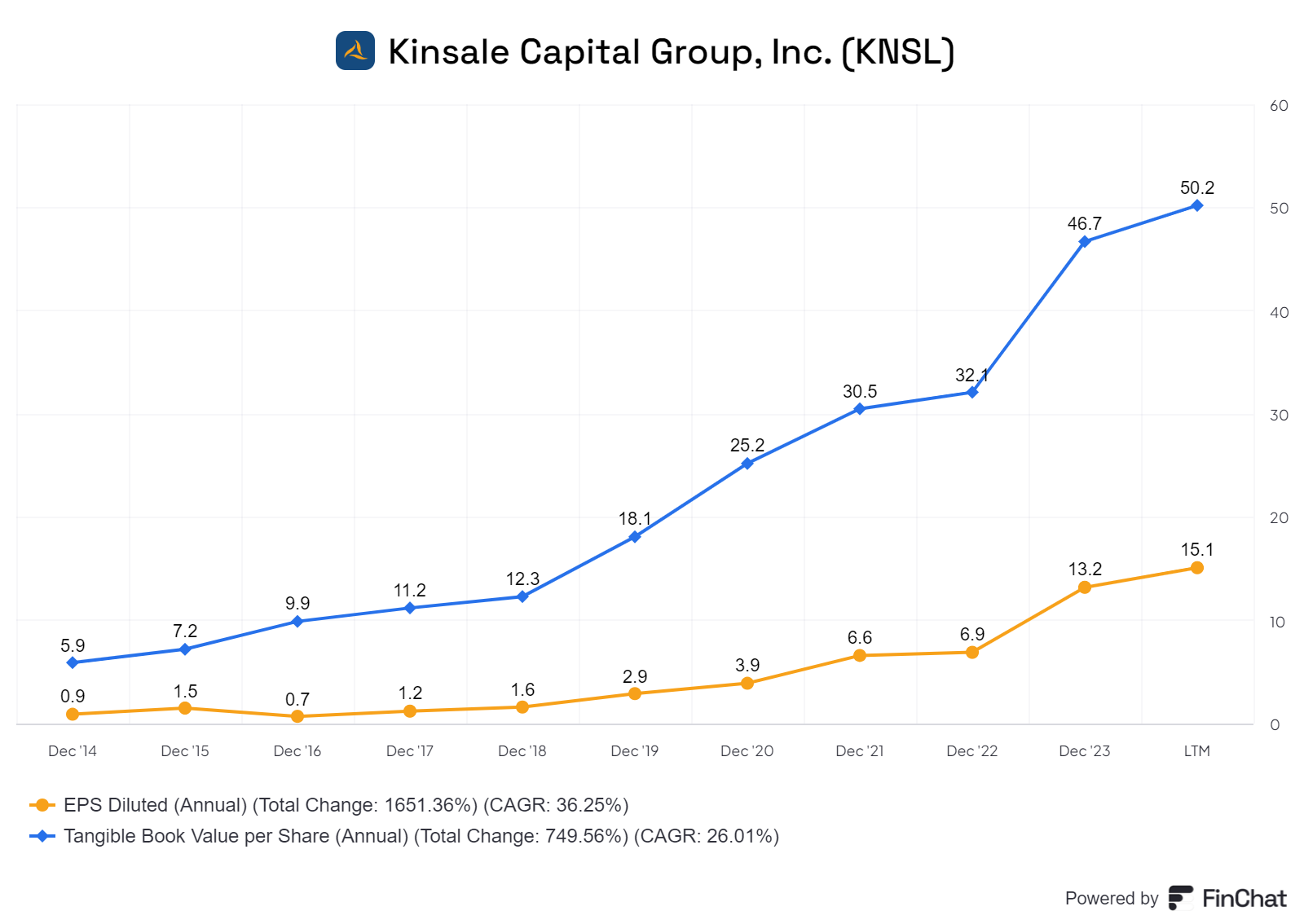

While Nvidia grew earnings and book value per share at compound annual growth rates of 55% and 30% respectively over the past 9 years (impressive!), we’ve been thinking about how attractive the U.S. P&C insurance industry has been for the past few years.

Take Kinsale Capital (KNSL) for example. The Virginia-based specialty P&C insurance company only underwrites smaller risks within the E&S market. The management team has grown EPS and book value per share at a CAGR of 36% and 26% over the past year while the shares have appreciated at a CAGR of 47%.

Retire Rich & Happy

Retailer in the Spotlight - Lululemon | 6.7.24

Lululemon Steals the Show

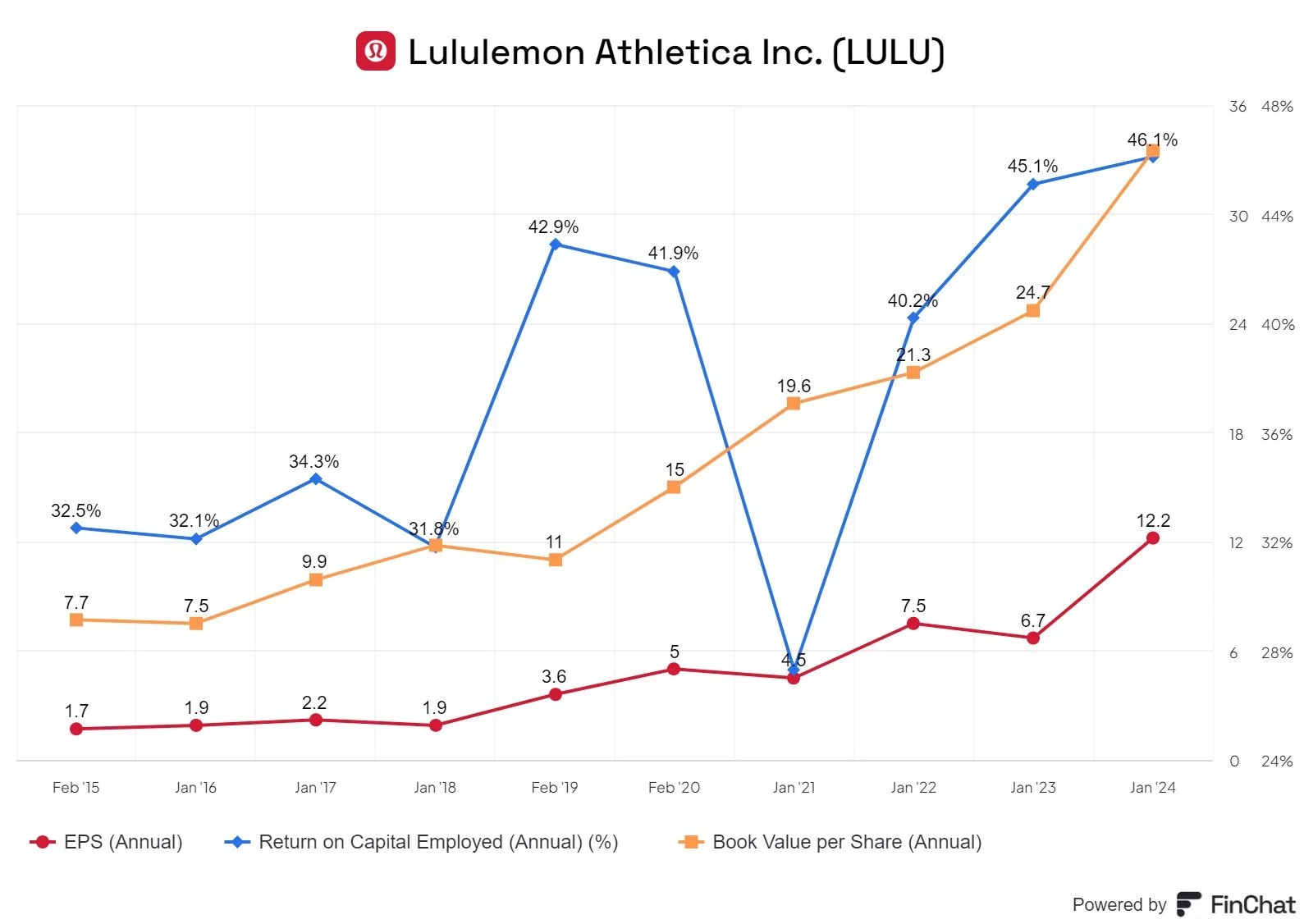

At Eaglestone Capital, we love companies that earn high returns on capital employed (ROCE) while growing earning per share (EPS) and compounding book value. Case in point, Lululemon (LULU) reported this week that it has grown EPS 7.2x, grown book value 4.5x and grown ROCE 44% over the past 9 years while their share price has compounded at an annual rate of 20% (returned 5.1x the original share price). As of June 5, 2024, the Company had approximately $1.7 billion remaining authorized under its stock repurchase program.