China/U.S. Freight Costs Rising - Is the U.S. Supply Chain Next?

How to Play A Rebounding U.S. Supply Chain

Domestic LTL Trucking Companies Offer an Attractive Option

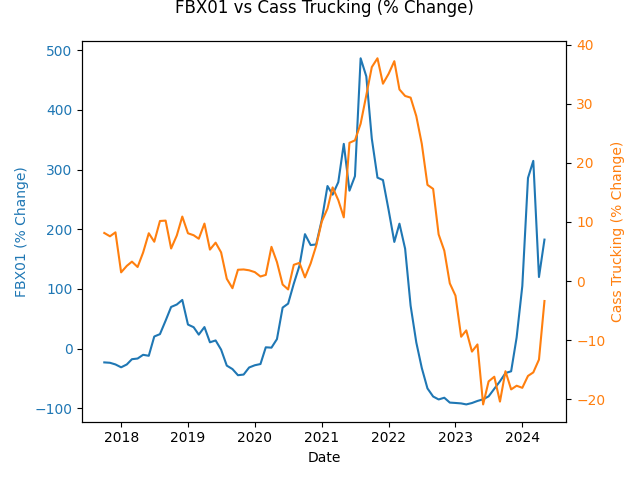

Over the past two months, we’ve been following re-bounding 40’ ocean going container rates, specifically the cost to ship goods from China to the U.S. West Coast. The Freightos FBX01 rate for example has risen over 127% from $3095 in April 2024 to over $7052 as of last week.

A number of explanations exist - disruptions in the Red Sea, retailers pre-buying in fear of post-election tariffs - however, there’s also something happening in the domestic supply chain that suggests the effects might be more substantial. Inferred rates withing the domestic Cass Freight Index have started to move and historically changes in the price of the two indexes (FBX01 and Cass Freight Index Inferred Prices) have been strongly corelated using a 5 month lag (i.e. the FBX01 rates “forecast” the Cass Freight Inferred Prices with a 5 month lag).

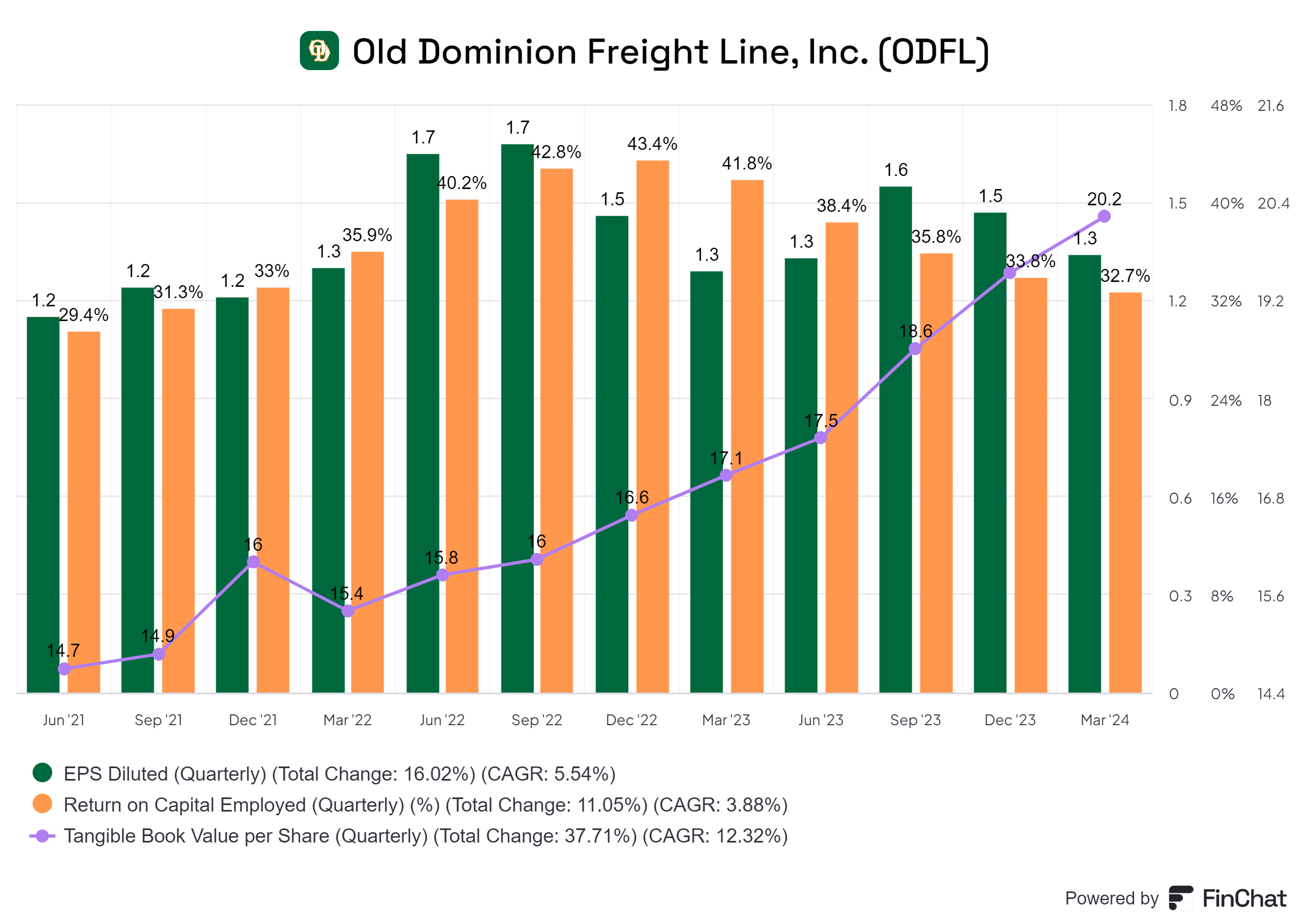

One idea is to look at the LTL trucking industry - Old Dominion Freight Lines (ODFL) for example. ODFL has demonstrated strong returns on capital employed (ROCE) over the years - over 30% - as well as consistently building book value per share through high returns and re-investment - all for the benefit of its shareholders.